Restaurant Labor Cost Formula- What You Need To Know About Paying Employees

What is Restaurant Labor Cost?

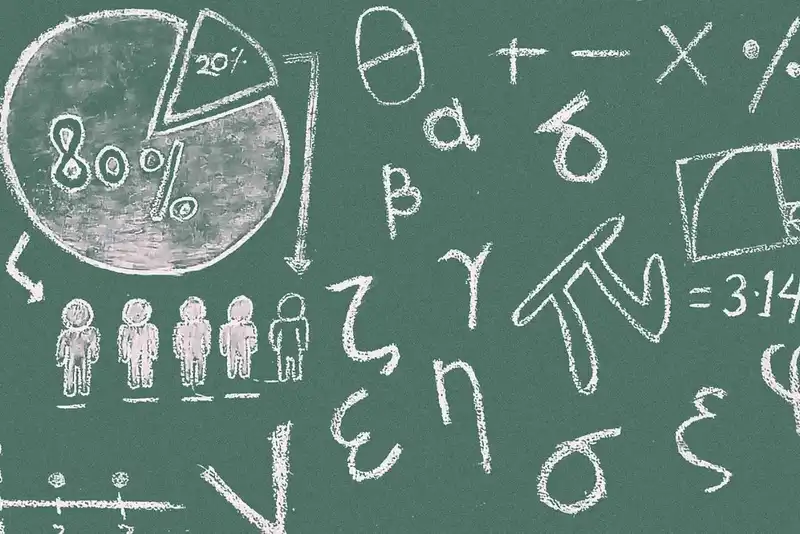

At around 35% of the total revenue, a restaurant spends the maximum on labor after rent. And the cost of restaurant labor is ever increasing. Hence, as a restaurant owner or manager, it is important for you to track the restaurant labor cost and labor percentage, now that the minimum wage is on rising around the country. Labor costs are always changing and require tracking and reporting on a regular basis.

So, what is the labor cost for a restaurant?

The total amount a restaurant spends on labor, which includes paying for regular and hourly workers, taxes, and employee benefits, is called labor cost for a restaurant.

When you calculate restaurant labor cost, you have to take into account salaried employee wages, hourly employee wages, any bonuses or overtime paid, payroll taxes, health care, and any sick and vacation days.

What is a Restaurant Labor Cost Formula?

After discussing what restaurant labor costs are, let us now look at how to calculate labor costs.

To derive the formula for restaurant labor cost, you first need to calculate the total amount your restaurant spends on labor. You can segment your labor cost by roles like hourly and salary staff to help you track labor costs. Here is how you can Calculate Restaurant labor rate-

- Make a list of employees with the same salary and split them into groups like the back of house or front of house or an even detailed list like cooks, servers.

- Add the total number of hours worked by each pay group for hourly employees. Let's say the total hours worked for servers for the week was 500.

- Multiply the total number of hours worked by the hourly rate. You can check the department of labor website to check the rates in your state. Let us say the hourly rate was $7. Hence, it will be 500 hours multiplied by $7 500x7=3500.

- Divide the figure by the number of weeks or months in a year 3500/52= $67.3 or 3500/12 = $291.6. Hence you know that you pay $67.3 per hour worked in an average week or $291.6 per hour worked in an average month.

- Add the wages in each pay grade to determine total labor cost by hours worked $67.3 for servers + average cost for other departments worked = Total restaurant labor costs by hours worked.

Restaurant labor costs are one of the largest expenses for any restaurant.

Zipschedules has a few tips for you that will help you reduce your restaurant labor cost formula and keep your restaurant running smoothly.

How is Restaurant Labor Cost Determined?

Any restaurant has two main expenses while running a business food and beverage cost and labor costs. The food costs and restaurant labor rate combined together make the prime cost. The prime cost is generally around 60% of the total sales or revenue. Let us now look at the components that help determine restaurant labor cost-

- Hourly employees- To calculate the cost of your hourly employees, add the total hours worked by your hourly staff per week and multiply by the hourly wage. If you pay different staff different hourly wages, calculate the number of hours worked by each employee and multiply by the wage. Total weekly cost of all hourly employees and divide it by total weekly sales to determine the percentage of sales Total weekly cost of all hourly employees / weekly sales = percentage of sales paid to hourly employees.

- Salaried staff- Calculate the weekly salary of any salaried employee by dividing the annual salary by 52 weeks Annual salary/ 52 = weekly salary of salaried staff. Total weekly cost of your salaried staff and divide by your weekly sales Total weekly cost of salaried employees/ weekly sales = percentage of sales paid to salaried staff.

- You can also calculate the total employee cost by adding the weekly cost of hourly employees and salaried staff and then dividing by your weekly sales to determine the total percentage of sales Total weekly cost of salaried employees + Total weekly cost of hourly employees/ weekly sales = Total percentage of sales.

- Taxes and benefits- You must also take into account payroll taxes while calculating restaurant labor cost. Calculate the payroll taxes for each employee for a week and add them together to get the total weekly payroll taxes. If you provide benefits such as health insurance or a retirement plan, add that amount to your calculation. So, the payroll taxes can be calculated as Total payroll taxes for all employees + Any benefits = Total weekly payroll taxes.

What is Labor Cost Percentage and how to calculate it?

You calculate the labor cost to know exactly how much of your revenue is being spent on labor but more important for you to know is the money spent on labor to produce revenue. To know this you have to calculate labor cost as a percentage. There are two ways to calculate Labor Cost as percentage Cost percentage of sales and cost percentage of total operating costs.

- Here is how you can calculate the labor cost percentage of total sales- We have already seen how we can calculate the total labor cost. Then calculate the restaurant's revenue the total weekly sales before taxes or other deductions and divide your weekly labor cost by the weekly revenue. Total Labor Cost/Total Sales = Labor cost as a percentage. So, if the total labor price is $5,000 and total revenue is $11,000 then restaurant labor cost percentage would be 5,000 /11,000 = 0.45 or 45%

- Here is how you can calculate the labor cost percentage of total operating costs- Calculate the total labor cost and total operating cost (sales, marketing costs, rent, food, drink, and any other expense). Divide total labor cost by total operating costs to get labor cost percentage Total labor costs / total operating costs = Labor cost as a percentage of total operating costs. So, if the total labor cost is 9,000 and the operating cost is $15,000 then Labor cost as a percentage will be 9,000/15,000 = 0.6 or 60%.

What is a good percentage of labor cost?

A good percentage of labor cost varies according to the industry and the business model but most restaurants try to keep labor cost percentage between 25-35% of total sales

Here are some labor costs average based on types of restaurants-

- Fast food restaurants can have labor costs of 25% of the total revenue as the food moves faster, they have higher profit margins are higher and the labor is not specialized hence costing less.

- Table service restaurants spend 30-40% of their revenue on labor cost depending on the menu and service offered.

- Fine dining restaurants are on the higher end as they spend 40% or beyond on the labor cost as most products are made in-house increasing the demand for labor.

But these are just benchmarks that can indicate your performance and every restaurant has different strengths and challenges. Just knowing a number but not understanding the overall picture will not make it easy to set long-term goals. If you have high labor costs, you need to understand the reason behind your labor costs.

You’re struggling to keep your restaurant afloat. You’ve cut down on the food costs and you know how to save money on utilities, but you’re still coming up short.

In this guide as suggested by Zipschedules, we’ll explore the restaurant labor cost formula and how it can help you control your labor costs.

How to Calculate Prime Cost

The restaurant labor cost is a part of the prime cost which is a measure to analyze the efficiency of restaurant operations. The prime cost is the total cost of goods sold (CoGS) and the total labor cost and is the most controllable expense. The restaurant cost of goods sold (CoGS) includes the cost of food and beverages, packaging, and costs needed for preparing and serving your menu items.

There are two ways to increase profits by increasing total sales and by managing prime costs. You can boost sales by opting for email marketing, loyalty programs, and gift cards. But even when your restaurant is operating at full capacity, you can still boost your profits by optimizing your prime costs. For instance, a dish in your restaurant priced at $10 has a prime cost of $6 which leaves a profit of $4 but if you can lower the prime cost to $4, then your profit increase by $2 without increasing the price.

How to calculate Prime Cost?

As discussed, Total cost of goods sold (CoGS) + Total Labor = Prime Cost. The total cost of goods sold includes all products bought to be used in your restaurant beverage and food costs, packaging costs, cleaning supplies costs. The total labor refers to your labor costs plus payroll taxes, benefits, and insurance.

You can get the prime cost percentage when you divide the prime cost by total sales Prime Cost / Total Sales = Prime Cost as a percentage. So, if the total cost of goods sold (CoGS) is $30,000 and total restaurant labor is $ 4,000 and then factor in taxes and other benefits to bring costs up to $5,000. Therefore 30,000 + 5,000 = $35,000 is the prime cost.

If the total sales were $60,000, then prime cost as a percentage of sales will be 35,000/60,000 = 0.58 or 58%.

As per statistics, the prime cost for a full-service restaurant are around 65% of total sales and for a limited-service restaurant, prime costs are typically around 60% or less. But the industry benchmark is 60% or lower with 30% for CoGS and 30% for restaurant labor.

Tips for controlling restaurant labor cost

As the world recovers from the pandemic, the economic effects are still being felt. The restaurant industry is now facing new regulations after raising the minimum wage as they have to deal with regulations about tipped, hourly, and other types of labor.

Faced with these new problems, it is best to opt for software like ZipSchedules which apart from employee scheduling also helps a restaurant track its labor costs and stay compliant with the laws.

Apart from investing in good software to streamline the restaurant labor calculation here are some tips to reduce restaurant labor costs-

- Control attrition rate- Attrition rate deals with not only the gap left by departing workers but also costs related to recruitment and training of new workers and lost working hours.

- As a restaurant, you need to provide better growth opportunities, offer incentives like employee loyalty programs and improve the work culture to control the attrition rate.

- Appropriate salary structure- You should work on a composite salary package that has fixed and commission-based incentives. Turn your pension or retirement plans into profit-sharing programs. Appoint the part-time workforce on full commission-based packages. Review the profits and salaries on a regular basis.

- Cross-training- As a restaurant owner, it is important to train your staff to handle multiple tasks as this ensures a workforce that can work in multiple positions in case of emergencies and also leads to the growth of professional capabilities. Cross-training also increases efficiency and provides team-building opportunities.

- Part-time help- Hourly workers have to be paid less than permanent employees and you don't have to invest in as many statutory benefits commitments. They can perform unskilled and general chores and reduce the burden on permanent staff.

- Measure employee efficiency- Define goals and set key performance indicators to analyze the performance of your staff. Improving employee efficiency is a great way of reducing restaurant labor costs. Analyze each aspect of your business and take appropriate actions to effectively manage labor costs.

Restaurant owners know that labor is one of the most expensive parts of running a restaurant.

In this guide as suggested by Zipschedules, we’ll explore some of the best ways that you can control your labor costs through the restaurant labor cost formula.